Factors Influencing millennials Adoption of Mobile Banking in East Lombok:Application of The UTAUT Model

Submission to VIJ 2024-08-21

Keywords

- Mobile Banking, Millennials, UTAUT, Behavioral Intention.

Copyright (c) 2024 Ardian Sukirman Aji, Taufiq Chaidir

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

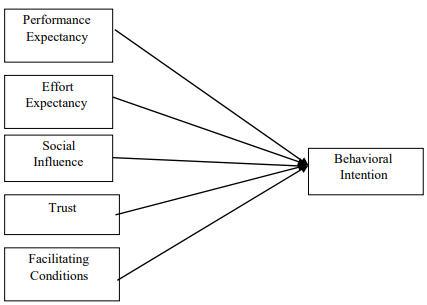

The author's purpose in conducting this research is for analyze the variables that influence the adoption of mobile banking by the millennial generation inside the East Lombok region. This study uses descriptive quantitative methodology and the UTAUT (Unified Theory of Acceptance and Use of Technology) model developed under(Venkatesh, Morris, Davis, & Davis, 2003). The type of research used is explanatory research collected through digitally distributed surveys, using the PLS-SEM model technique, the research sample consists of 123 mobile banking customers from the millennial generation in East Lombok district, with five samples per sub-district. Research findings, performance expectations, and effort expectations do not appear to significantly influence the millennial periods tendency for employ mobile banking in East Lombok Regency.

References

- Ajzen, I., & Fishbein, M. (1980). Attitudes and the Attitude-Behavior Relation: Reasoned and Automatic Processes. European Review of Social Psychology, 11(1), 1—33. https://doi.org/10.1080/14792779943000116

- Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99—110. https://doi.org/10.1016/j.ijinfomgt.2017.01.002

- Anjani, W., & Mukhlis, I. (2022). Penerapan Model UTAUT (The Unified Theory of Acceptance and Use of Technology) Terhadap Minat dan Perilaku Penggunaan Mobile Banking. Jurnal Ekonomi Akuntansi Dan Manajemen, 21(1), 1. https://doi.org/10.19184/jeam.v21i1.30570

- Bankole, F. O., Bankole, O. O., & Brown, I. (2011). Mobile Banking Adoption in Nigeria. Electronic Journal of Information Systems in Developing Countries, 47(1), 1—23. https://doi.org/10.1002/j.1681-4835.2011.tb00330.x

- Boonsiritomachai, W., & Pitchayadejanant, K. (2019). Determinants affecting mobile banking adoption by generation Y based on the unified theory of acceptance and use of technology model modified by the technology acceptance model concept. Kasetsart Journal of Social Sciences, 40(2), 349—358. https://doi.org/10.1016/j.kjss.2017.10.005

- Chaidir, T., Rois, I., & Akhmad Jufri. (2021). Penggunaan Aplikasi Mobile Banking Pada Bank Konvensional dan Bank Syariah di Nusa Tenggara Barat: Pembuktian Model Unified Theory of Acceptance and Use of Technology (UTAUT). Elastisitas - Jurnal Ekonomi Pembangunan, 3(1), 61—76. https://doi.org/10.29303/e-jep.v3i1.37

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly: Management Information Systems, 13(3), 319—339. https://doi.org/10.2307/249008

- Dawood, H. M., Liew, C. Y., & Lau, T. C. (2021). Mobile perceived trust mediation on the intention and adoption of FinTech innovations using mobile technology: A systematic literature review. F1000Research, 10(March), 1252. https://doi.org/10.12688/f1000research.74656.1

- Deameta, A. F. (2018). Prediksi Intensi Perilaku terhadap Penggunaan Mobile Bangking Menggunakan THE UNIFIED THEORY OF ACCEPTANCE AND USE OF TECHNOLOGY, TRUST, DAN NETWORK EXTERNALITIES. Sereal Untuk, 51(1), 51.

- Elhajjar, S., & Ouaida, F. (2020). An analysis of factors affecting mobile banking adoption. International Journal of Bank Marketing, 38(2), 352—367. https://doi.org/10.1108/IJBM-02-2019-0055

- Gupta, A., Dogra, N., & George, B. (2018). What determines tourist adoption of smartphone apps?: An analysis based on the UTAUT-2 framework. Journal of Hospitality and Tourism Technology, 9(1), 48—62. https://doi.org/10.1108/JHTT-02-2017-0013

- Hidayatullah, S., Waris, A., & Devianti, R. C. (2018). Perilaku Generasi Milenial dalam Menggunakan Aplikasi Go-Food. Jurnal Manajemen Dan Kewirausahaan, 6(2), 240—249. https://doi.org/10.26905/jmdk.v6i2.2560

- I. Ghozali and H. Latan. (2015). Partial Least Squares : Konsep, Teknik dan Aplikasi Menggunakan Program SmartPLS 3.0, -2/E. Semarang: Undip.

- Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A developing country perspective. Computers in Human Behavior, 54, 453—461. https://doi.org/10.1016/j.chb.2015.08.039

- Mayanti, R. (2020). Faktor-Faktor Yang Mempengaruhi Penerimaan User Terhadap Penerapan Quick Response Indonesia Standard Sebagai Teknologi Pembayaran Pada Dompet Digital. Jurnal Ilmiah Ekonomi Bisnis, 25(2), 123—135. https://doi.org/10.35760/eb.2020.v25i2.2413

- Mazhar, F., Rizwan, M., Fiaz, U., Ishrat, S., Razzaq, M. S., & Khan, T. N. (2014). An Investigation of Factors Affecting Usage and Adoption of Internet & Mobile Banking In Pakistan. International Journal of Accounting and Financial Reporting, 1(1), 478. https://doi.org/10.5296/ijafr.v4i2.6586

- Nopiani &Made Pande Dwiana Putra. (2021). Analisis Faktor-Faktor yang Mempengaruhi Kinerja Keuangan Lembaga Perkreditan Desa di Kabupaten Badung. E-Jurnal Akuntansi, 31(10), 2621. https://doi.org/10.24843/eja.2021.v31.i10.p17

- Obeid, H., & Kaabachi, S. (2016). Empirical investigation into customer adoption of Islamic banking services in Tunisia. Journal of Applied Business Research, 32(4), 1243—1256. https://doi.org/10.19030/jabr.v32i4.9734

- Oktavianita, A. D. (2021). Pengaruh Faktor Model UTAUT (Unified Theory of Acceptance and Use of Technology) Terhadap Niat Generasi Milenial Dalam Menggunakan Mobile Banking di …. Jurnal Ekonomi Dan Bisnis (EK&BI), 4, 649—660. https://doi.org/10.37600/ekbi.v4i2.414

- Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61(2016), 404—414. https://doi.org/10.1016/j.chb.2016.03.030

- Purwanto, E., & Loisa, J. (2020). The Intention and Use Behaviour of the Mobile Banking System in indonesia: UTAUT Model. Technology Reports of Kansai University, 62(06), 2757—2767. Retrieved from https://www.researchgate.net/publication/343230847

- Sari, A., & Yoseph Agus Bagus Budi N. (2023). Faktor Faktor Yang Mempengaruhi Minat Generasi Milenial Dalam Menggunakan Mobile Banking. Jurnal Ekonomi Trisakti, 3(1), 1437—1446. https://doi.org/10.25105/jet.v3i1.16132

- Sarstedt, M., Ringle, C. M., & Hair, J. F. (2017). Handbook of Market Research. Handbook of Market Research. https://doi.org/10.1007/978-3-319-05542-8

- Savić, J., & Pešterac, A. (2019). Antecedents of mobile banking: UTAUT model. The European Journal of Applied Economics, 16(1), 20—29. https://doi.org/10.5937/ejae15-19381

- Shareef, M. A., Baabdullah, A., Dutta, S., Kumar, V., & Dwivedi, Y. K. (2018). Consumer adoption of mobile banking services: An empirical examination of factors according to adoption stages. Journal of Retailing and Consumer Services, 43(February), 54—67. https://doi.org/10.1016/j.jretconser.2018.03.003

- Tan, M. C., Zariyawati, M. A., & Hirnissa, M. T. (2021). The Application of UTAUT Theory to Determine Factors Influencing Malaysian Adoption Mobile Banking. International Journal of Academic Research in Business and Social Sciences, 11(1). https://doi.org/10.6007/ijarbss/v11-i1/8448

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly: Management Information Systems, 27(3), 425—478. https://doi.org/10.2307/30036540

- Zhou, T. (2011). An empirical examination of initial trust in mobile banking. Internet Research, 21(5), 527—540. https://doi.org/10.1108/10662241111176353