Optimization of National Zakat Management through the Effectiveness of the Role of Stakeholders of Zakat Management Organizations

Submission to VIJ 2024-07-09

Keywords

- Zakat Governance, Governance Reform, Zakat Management Institutions, Zakat System

Copyright (c) 2024 Abdul Haris

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

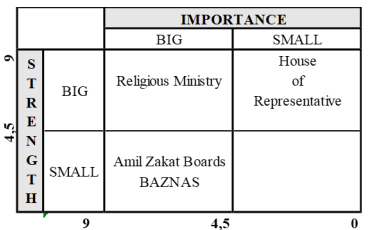

This research shows that stakeholders are running the Zakat governance system effectively. There is a contradiction in the role between the regulatory and executive functions of the national zakat management institution. The research method used is descriptive qualitative, which compares ideal conditions with actual conditions through secondary data research, interviews, and group discussions. The data processed are in the form of zakat law documents, government regulations, BAZNAS regulations, zakat acquisition calculation index, data from the central statistics agency, minutes of discussion group forums and confirming interviews with sources of amil zakat, samples using the purposive sampling method by finding samples through snowball sampling techniques. The study results show that reforms need to be carried out immediately on the role of zakat governance stakeholders so that national zakat management is more optimal and effective and, in the end, can provide more comprehensive benefits for the community

References

- Achmad Muchaddam Fahham. (2020). Pengelolaan Zakat Di Indonesia https://berkas.dpr.go.id/puslit/files/buku_individu/buku-individu-public-38.pdf

- Akbar, T., & Siti-Nabiha, A. K. (2022). Objectives and measures of performance of Islamic microfinance banks in Indonesia: the stakeholders’ perspectives. ISRA International Journal of Islamic Finance, 14(2), 124–140. https://doi.org/10.1108/IJIF-11-2020-0231

- Asfarina, M., Ascarya, & Beik, I. S. (2019). Classical And Contemporary Fiqh Approaches To Re-Estimating The Zakat Potential In Indonesia. Journal of Islamic Monetary Economics and Finance, 5(2). https://doi.org/10.21098/jimf.v5i2.1068

- Badan Amil Zakat Nasional. (2019). Indikator Pemetaan Potensi Zakat (IPPZ). https://drive.google.com/file/d/1-eaMjj3JYoiPlXu29E88B61QpP0t5938/view

- Badan Amil Zakat Nasional. (2020). Rencana Strategis Badan Amil Zakat Nasional 2020-2025. https://drive.google.com/file/d/16RRtfgeZjl4vQh8DVfHHM2i6ahgkp3C4/view

- Badan Amil Zakat Nasional. (2022). Laporan Zakat Dan Pengentasan Kemiskinan 2022. https://drive.google.com/file/d/16sWxv1yoRy9IYDj5TL-C6QefaM-FxMAa/view

- Badan Amil Zakat Nasional. (2023). Outlook Zakat Indonesia. https://drive.google.com/file/d/1PyxTz9u5E4-tyXqJXrE-xAoJBHmD3lyf/view

- Bank Indonesia. (2019). Pengelolaan Zakat yang Efektif. https://www.bi.go.id/id/edukasi/Documents/Buku-Pengelolaan-Zakat.pdf

- Chandra, Y., & Shang, L. (2019). Qualitative Research Using R: A Systematic Approach. Qualitative Research Using R: A Systematic Approach, 1–151. https://doi.org/10.1007/978-981-13-3170-1

- Fahmi Ali Hudaefi, Abdul Aziz Yahya Saoqi, H. F. and U. L. J. (2020). a Case Study of Baznas, Indonesia. Journal of Islamic Monetary Economics and Finance, 6(4), 919–934.

- Harrison, J. S., Barney, J. B., Freeman, R. E., & Phillips, R. A. (2019). Stakeholder theory. The Cambridge Handbook of Stakeholder Theory, 3–18. https://doi.org/10.1017/9781108123495.001

- Iskandar, A., Possumah, B. T., Aqbar, K., & Yunta, A. H. D. (2021). Islamic Philanthropy and Poverty Reduction in Indonesia: The Role of Integrated Islamic Social and Commercial Finance Institutions. Al-Ihkam: Jurnal Hukum Dan Pranata Sosial, 16(2), 274–301. https://doi.org/10.19105/AL-LHKAM.V16I2.5026

- Nomran, N. M., & Haron, R. (2022). Validity of zakat ratios as Islamic performance indicators in Islamic banking: a congeneric model and confirmatory factor analysis. ISRA International Journal of Islamic Finance, 14(1), 41–62. https://doi.org/10.1108/IJIF-08-2018-0088

- UU Zakat Nomer 38,(1999). https://www.dpr.go.id/dokjdih/document/uu/UU_1999_38.pdf

- Undang-Undang Tentang Wakaf, (2004). https://simpuh.kemenag.go.id/regulasi/uu_41_04.pdf

- Undang-Undang Republik Indonesia Nomor 23 Tahun 2011 Tentang Pengelolaan Zakat, (2011). https://peraturan.go.id/files/uu23-2011bt.pdf

- Ridwan, M., Asnawi, N., & Sutikno. (2019). Zakat collection and distribution system and its impact on the economy of Indonesia. Uncertain Supply Chain Management, 7(4), 589–598. https://doi.org/10.5267/j.uscm.2019.6.001

- Sa’adah, M., & Hasanah, U. (2021). The Common Goals of BAZNAS’ Zakat and Sustainable Development Goals (SDGs) according to Maqasid Al-Sharia Perspective. Al-Ihkam: Jurnal Hukum Dan Pranata Sosial, 16(2), 302–326. https://doi.org/10.19105/AL-LHKAM.V16I2.4990

- Widiastuti, T., Auwalin, I., Rani, L. N., & Ubaidillah Al Mustofa, M. (2021). A mediating effect of business growth on zakat empowerment program and mustahiq’s welfare. Cogent Business and Management, 8(1). https://doi.org/10.1080/23311975.2021.1882039

- Yasoa’, M. R., Abdullah, W. A. W., & Endut, W. A. (2020). The role of shariah auditor in islamic banks: The effect of shariah governance framework (SGF) 2011. International Journal of Financial Research, 11(4), 443–452. https://doi.org/10.5430/ijfr.v11n4p443

- Zawacki-Richter, O., Kerres, M., Bedenlier, S., Bond, M., & Buntins, K. (2019). Systematic Reviews in Educational Research: Methodology, Perspectives and Application. Systematic Reviews in Educational Research: Methodology, Perspectives and Application, 1–161. https://doi.org/10.1007/978-3-658-27602-7