Examining Dividend Policy as a Mediating Variable in Stock Price Trends: Evidence from the Indonesian Basic Materials

Submission to VIJ 2024-07-02

Keywords

- financial ratios, stock price, dividend policy, raw materials sector

Copyright (c) 2024 Dehan Azzahrah Nurmahfudi, Prof. Dr. YUNININGSIH, S.E., M.Si

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

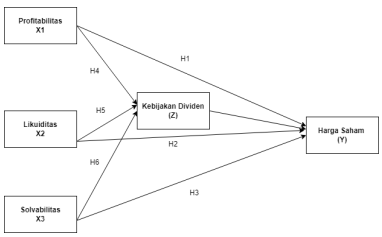

This research investigates the impact of financial ratios, including profitability, liquidity and solvency, on stock prices, with dividend policy as a mediator, in the Indonesian raw materials sector. The analysis covers 100 samples from 25 of companies listed on the Indonesia Stock Exchange (BEI) from 2019 to 2022. The research aims to explore stock price fluctuation trends and examine the relationship between financial ratios and stock prices, as well as the role of dividends policy in mediating this relationship. The findings show that profitability and liquidity are important factors in determining stock prices, while solvency does not influence stock prices, nor does dividend policy play an important role in mediating the relationship between variables. It is hoped that these findings will provide insight for investors, policy makers and industry stakeholders in navigating Indonesia's dynamic construction materials market.

References

- Admi, A. P. (N.D.). The Effect Of Liquidity, Leverage Ratio, Activities And Profitability On Stock Prices With Dividend Policy As Intervening Variables In Manufacturing Companies In Indonesia And Malaysia 2015-2017.

- Akhmadi, A., Nurohman, N., & Robiyanto, R. (2021). The Mediating Role Of Debt And Dividend Policy On The Effect Profitability Toward Stock Price. Jurnal Manajemen Dan Kewirausahaan, 22(1), 1–10. Https://Doi.Org/10.9744/Jmk.22.1.1-10

- Ali, J., Faroji, R., & Ali, O. (2021). Pengaruh Profitabilitas Terhadap Nilai Perusahaan (Studi Empiris Pada Perusahaan Sektor Industri Barang Konsumsi Di Bursa Efek Indonesia Tahun 2017-2019).

- Al-Malkawi, H.-A. N., Rafferty, M., & Pillai, R. (N.D.). Dividend Policy: A Review Of Theories And Empirical Evidence.

- Anggadini, S. D., Surtikanti, S., Andriyani Erik, A. P., & Damayanti, S. (2022). Determination Of Profitability And Liquidity On Stock Price. Jurnal Riset Akuntansi, 14(2), 159–167. Https://Doi.Org/10.34010/Jra.V14i2.5119

- Bangun, N., & Natsir, K. (2021). A Study On The Relationship Between Enterprise Risk Management, Free Cash Flow, And Dividend Payout Ratio On Stock Price Of Consumer Goods: International Conference On Economics, Business, Social, And Humanities (ICEBSH 2021), Jakarta, Indonesia. Https://Doi.Org/10.2991/Assehr.K.210805.174

- Block, S. B., Hirt, G. A., & Danielsen, B. R. (2011). Foundations Of Financial Management (14th Ed). Mcgraw-Hill/Irwin.

- Bustami, F., & Haikal, J. (2019). Determinants Of Return Stock Company Real Estate And Property Located In Indonesia Stock Exchange. International Journal Of Economics And Financial Issues, 9(1).

- Deitiana, T. (2011). Pengaruh Rasio Keuangan, Pertumbuhan Penjualan Dan Dividen Terhadap Harga Saham.

- Elizabeth Sugiarto Dermawan, S. L. (2019). Pengaruh Profitabilitas, Likuiditas, Solvabilitas, Aktivitas, Dan Kebijakan Dividen Terhadap Harga Saham. Jurnal Paradigma Akuntansi, 1(2), 381. Https://Doi.Org/10.24912/Jpa.V1i2.5100

- Fitri, C. G., & Wikartika, I. (2022). Analisis Rasio Keuangan Dan Price To Book Value Terhadap Harga Saham Dengan Earning Per Share Sebagai Variabel Moderasi Pada Perusahaan Food And Beverage Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Ilmiah Universitas Batanghari Jambi, 22(3), 1845. Https://Doi.Org/10.33087/Jiubj.V22i3.2487

- Hertina, D., & Hidayat, M. B. H. (2019). Pengaruh Likuiditas, Solvabilitas Dan Nilai Pasar Terhadap Return Saham. JEMPER (Jurnal Ekonomi Manajemen Perbankan), 1(1), 43. Https://Doi.Org/10.32897/Jemper.V1i1.128

- Hestiatay, A. N., Machmuddah, Z., & Tah, N. (2023). The Influence Of Liquidity, Solvency, Profitability, And Company Size On Stock Prices. Dinamika Akuntansi Keuangan Dan Perbankan, 12(1), 75–86. Https://Doi.Org/10.35315/Dakp.V12i1.9115

- Kusnandar, K., & Sari, M. (2020). The Effects Of Liquidity, Solvency, And Profitability On Stock Price (A Study In PT. Telekomunikasi Indonesia Tbk. Period Of 2004-2018). Journal Of Accounting And Finance Management, 1(5), 250–261. Https://Doi.Org/10.38035/Jafm.V1i2.30

- Marsela, P., & Yantri, O. (2021). Pengaruh Profitabilitas, Likuiditas Dan Solvabilitas Terhadap Harga Saham Pada Sektor Transportasi Yang Terdaftar Di BEI Tahun 2014-2018. Zona Keuangan: Program Studi Akuntansi (S1) Universitas Batam, 11(1), 41–53. Https://Doi.Org/10.37776/Zuang.V11i1.765

- Murhadi, W. R. (N.D.). Studi Kebijakan Deviden: Anteseden Dan Dampaknya Terhadap Harga Saham.

- Nalarreason, K. M., T, S., & Mardiati, E. (2019). Impact Of Leverage And Firm Size On Earnings Management In Indonesia. International Journal Of Multicultural And Multireligious Understanding, 6(1), 19. Https://Doi.Org/10.18415/Ijmmu.V6i1.473

- Nuraini, F. D., & Suwaidi, R. A. (2022). Pengaruh Leverage, Likuiditas, Dan Ukuran Perusahaan Terhadap Profitabilitas Pada Perusahaan Textile Dan Garment Yang Go Public Di Bursa Efek Indonesia. Jurnal Ilmu Manajemen, 11(2), 157. Https://Doi.Org/10.32502/Jimn.V11i2.3523

- Nurkhasanah, D., & Nur, D. I. (2022). Analisis Struktur Modal Pada Perusahaan Food And Beverage Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Manajemen, 16(1).

- Nurron, M., & Ichsanuddin Nur, D. (2022). Analisis Profitabilitas Pada Perusahaan Pertambangan Batubara Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Riset Pendidikan Ekonomi, 7(1), 28–40. Https://Doi.Org/10.21067/Jrpe.V7i1.5840

- Putra, A., & Rasyid, R. (2020). The Impact Of Dividend Policy On Stock Prices With Profitability As Variable Mediation In Manufacturing Companies Listed In Indonesia Stock Exchange: Proceedings Of The 5th Padang International Conference On Economics Education, Economics, Business And Management, Accounting And Entrepreneurship (PICEEBA-5 2020). The Fifth Padang International Conference On Economics Education, Economics, Business And Management, Accounting And Entrepreneurship (PICEEBA-5 2020), Padang, Indonesia. Https://Doi.Org/10.2991/Aebmr.K.201126.059

- Rahmawati, N., & Amboningtyas, D. (2017). The Influence Of Profitability And Leverage To Company Values With Divident Policies As Intervening Variable (In Lq 45 Company Listed In Bei Period Of 2012-2016). Journal Of Management, 3(3). Https://Jurnal.Unpand.Ac.Id/Index.Php/MS/Article/View/781

- Riyanti, R., & Hanifah, A. (2021). The Influence Of Solvability, Company Growth And Profitability On Divident Policy And Firm Value At LQ 45 Companies On The Indonesia Stock Exchange. Journal Of Accounting And Finance Management, 1(6), 287–301. Https://Doi.Org/10.38035/Jafm.V1i3.39

- Sholichah, F., Asfiah, N., Ambarwati, T., Widagdo, B., Ulfa, M., & Jihadi, M. (2021). The Effects Of Profitability And Solvability On Stock Prices: Empirical Evidence From Indonesia. The Journal Of Asian Finance, Economics And Business, 8(3), 885–894. Https://Doi.Org/10.13106/Jafeb.2021.Vol8.No3.0885

- Siagian, A. O., Wijoyo, H., & Cahyono, Y. (2021). The Effect Of Debt To Asset Ratio, Return On Equity, And Current Ratio On Stock Prices Of Pharmaceutical Companies Listed On The Indonesia Stock Exchange 2016-2019 Period. 3(2).

- Siregar, E. I. (2021). Kinerja Keuangan Terhadap Profitabiltas Sub Sektor Konstruksi. NEM.

- Sitorus, T., & Elinarty, S. (2017). The Influence Of Liquidity And Profitability Toward The Growth Of Stock Price Mediated By The Dividen Paid Out (Case In Banks Listed In Indonesia Stock Exchange). Journal Of Economics, Business & Accountancy Ventura, 19(3). Https://Doi.Org/10.14414/Jebav.V19i3.582

- Stereńczak, S., & Kubiak, J. (2022). Dividend Policy And Stock Liquidity: Lessons From Central And Eastern Europe. Research In International Business And Finance, 62, 101727. Https://Doi.Org/10.1016/J.Ribaf.2022.101727

- Wikartika, I., & Fitriyah, Z. (2018). Pengujian Trade Off Theory Dan Pecking Order Theory Di Jakarta Islamic Index. BISMA (Bisnis Dan Manajemen), 10(2), 90. Https://Doi.Org/10.26740/Bisma.V10n2.P90-101

- Yuniningsih, Y.-, Hasna, N. A., & Nizarudin Wajdi, M. B. (2018). Financial Performance Measurement Of With Signaling Theory Review On Automotive Companies Listed In Indonesia Stock Exchange. IJEBD (International Journal Of Entrepreneurship And Business Development), 1(2), 167–177. Https://Doi.Org/10.29138/Ijebd.V1i2.558

- Yuniningsih, Y., Pertiwi, T. K., & Purwanto, E. (2019). Fundamental Factor Of Financial Management In Determining Company Values. Management Science Letters, 205–216. Https://Doi.Org/10.5267/J.Msl.2018.12.002

- Yuniningsih, Y., Taufiq, M., Wuryani, E., & Hidayat, R. (2019). Two Stage Least Square Method For Prediction Financial Investment And Dividend. Journal Of Physics: Conference Series, 1175, 012212. Https://Doi.Org/10.1088/1742-6596/1175/1/012212