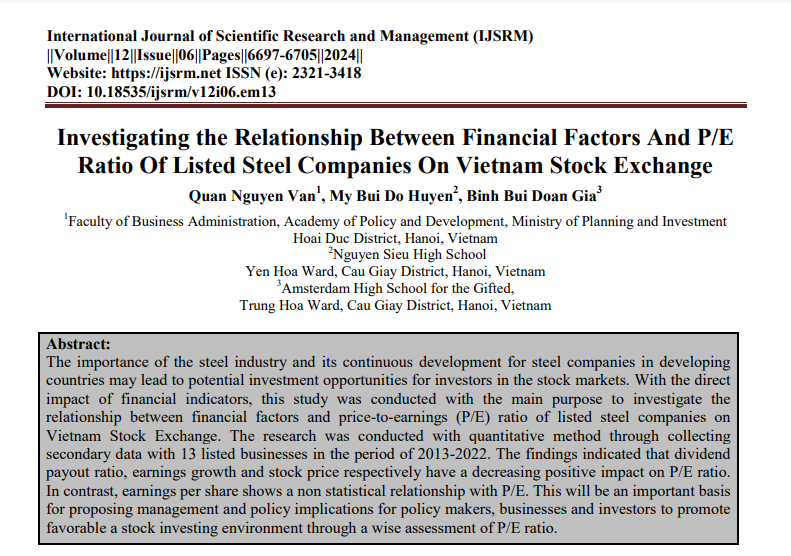

Investigating The Relationship Between Financial Factors And P/E Ratio Of Listed Steel Companies On Vietnam Stock Exchange

Submission to VIJ 2024-06-21

Keywords

- Dividend payout ratio,

- financial factors ,

- listed steel companies,

- price to earnings ratio

Copyright (c) 2024 Quan Nguyen Van, My Bui Do Huyen, Binh Bui Doan Gia

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

The importance of the steel industry and its continuous development for steel companies in developing countries may lead to potential investment opportunities for investors in the stock markets. With the direct impact of financial indicators, this study was conducted with the main purpose to investigate the relationship between financial factors and price-to-earnings (P/E) ratio of listed steel companies on Vietnam Stock Exchange. The research was conducted with quantitative method through collecting secondary data with 13 listed businesses in the period of 2013-2022. The findings indicated that dividend payout ratio, earnings growth and stock price respectively have a decreasing positive impact on P/E ratio. In contrast, earnings per share shows a non statistical relationship with P/E. This will be an important basis for proposing management and policy implications for policy makers, businesses and investors to promote favorable a stock investing environment through a wise assessment of P/E ratio.

References

- Arslan, H., Iltas, Y., & Kayhan, T. (2017). Target P/E ratio determinants in the Turkish Stock Market: Earning volatility effect. Theoretical and Applied Economics, 24(4), 65-74.

- Asad, I.A.A., Nour, A., & Atout, S. (2023). The Impact of Financial Performance on Firm’s Value During Covid-19 Pandemic for Companies Listed in the Palestine Exchange (2019–2020). In: Musleh Al-Sartawi, A.M.A., Razzaque, A., Kamal, M.M. (eds) From the Internet of Things to the Internet of Ideas: The Role of Artificial Intelligence, EAMMIS 2022, Lecture Notes in Networks and Systems, 557. Springer, Cham.

- Azam, M. (2010). Factors influencing the price-earnings multiples and stock values in the Karachi stock exchange. Interdisciplinary Journal of Contemporary Research in Business, 2(5), 105-139.

- Cam, N. (2023). Outlook for the global and Vietnam steel market in 2023. Available at: https://mrssteel.com.vn/blogs/steel-news/what-is-the-outlook-for-the-global-and-vietnam-steel-market-in-the-fir. (Accessed: 23 February 2024).

- Dutta, K.D., Saha, M., & Das, D.C. (2018). Determinants of P/E ratio: An empirical study on listed manufacturing companies in DSE. International Journal of Scientific and Research Publications, 8(4).

- Emudainohwo, O.B. (2017). Determinants of price-earnings ratio: Nigerian experience (quantile regression). International Journal of Economics, Business and Management Research, 1(5), 46–76.

- Freihat, A.R.F. (2019). Factors affecting price to earnings ratio (P/E): Evidence from the emerging market. Risk Governance and Control: Financial Markets and Institutions, 9(2), 47–56.

- Gacus, R.B., & Hinlo, J. (2018). The reliability of constant growth dividend discount model (DDM) in valuation of Philippine common stocks. International Journal of Economics & Management Sciences, 7(1), 2-9.

- Gaille, B. (2018). 16 Dividend valuation model advantages and disadvantages. Available at: https://brandongaille.com/16-dividend-valuation-model-advantages-anddisadvantages/.

- Goodman, D.A., & Peavy III, J.W. (1986). The interaction of firm size and price-earnings ratio on portfolio performance. Financial Analysts Journal, 42(1), 9-12.

- Gordon, M.J. (1962). The investment, financing, and valuation of the corporation. RD Irwin.

- Gottwald. R. (2012). The use of the P/E ratio to stock valuation. GRANT Journal, 21-24.

- Graham, B., & Dodd, D.L. (1934). Security analysis: Principles and technique. McGraw-Hill.

- Ho, T.H., Pham, T.T.H, Nguyen, T.T., & Nguyen, Q.N. (2023). Factors affecting financial risks: Evidence from steel enterprises listed on Vietnam’s stock market. International Journal of Advanced and Applied Sciences, 10(3), 75–81.

- Jeon, K. (2019). Vietnam’s Steel Industry: Characteristics And Steel Demand Forecast. POSCO Research Institute. Available at: https://posri.re.kr/files/file_pdf/82/16022/82_16022_file_pdf_1567402545.pdf (Accessed: 22 November 2023).

- Kecheng, S. (2022). Research on the Influencing Factors of the P/E Ratio of Listed Companies. 2022 International Conference on Education, Management, Business and Economics.

- Krishnan, C.N., & Chen, Y. (2017). The relationship between dividend payout and price to earnings. SSRN Electronic Journal.

- Nagendra, M., & Muruganandam, S. (2012). Intrinsic value: a tool for selection of the stocks. Seventh International Seminar on Financial Markets: Issues and Challenges (FIM IC - 2012), January 2012 conducted by Bharatidasan University, Tiruchirappalli. Tamilnadu, India. Available at SSRN: https://ssrn.com/abstract=3167150.

- Nayaata, P. (2009). The relationship between capital structure, earnings growth and price earnings ratio of firms listed at the NSE. The Requirements for the Degree of Master of Business Administration, School of Business, University of Nairobi.

- Nicolson, S.F. (1960). Price-Earnings Ratios. Financial Analysts Journal, 16(4), 43-45.

- Penman, S.H. (1996). The articulation of price–earnings ratios and market-to-book ratios and the evaluation of growth (digest summary). Journal of Accounting Research, 34(2), 235-259.

- Premkanth P. (2013). Determinant of price earning multiple in Sri Lanka listed companies. European Journal of Business and Innovation Research, 1(2), 44–56.

- Rahman, M.L., & Shamsuddin, A. (2019). Investor sentiment and the price-earnings ratio in the G7 stock markets. Pacific-Basin Finance Journal, 55, 46–62.

- Sajeetha, A.M., Nusaika, M.F., & Safana, M.N. (2023). An empirical study on determinants of price earnings ratio: Evidence from listed food, beverage and tobacco companies in Colombo Stock Exchange. Asian Journal of Economics, Business and Accounting, 23(10), 32–43.

- Saji, T.G., Kasim, M., & Harikumar, S. (2021). Price Earnings ratio as a tool in investment decision making A statistical analysis in the facet of Global financial crisis. Acumen, 2, 24-33.

- Siegel, J.J. (2021). Stocks for the long run the definitive guide to Financial Market Returns & Long-Term Investment Strategies (5th edn). New York: McGraw Hill.

- Statista Research Department. (2023) Vietnam: Steel production volume 2022, Statista.

- Wenjing, H. (2008). Price-earnings ratio and influence factors: evidence from China. Master’s Thesis in Accounting and Finance, University of VAASA, Finland, Faculty of Business Studies, Department of Accounting and Finance.

- Zhang, H. (2022). An Empirical Analysis of the Determinants of the P/E Ratio A Case Study of China’s Media Industry. Journal of Family Business and Management Studies, 14(2), 37–58.