Submission to VIJ 2024-06-21

Keywords

- Financila Inclusion,

- Consumption,

- Poverty,

- Quasi-Experimental,

- SUSENAS

Copyright (c) 2024 Ika Yuanita, Elni Sumiarti, Yenida

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

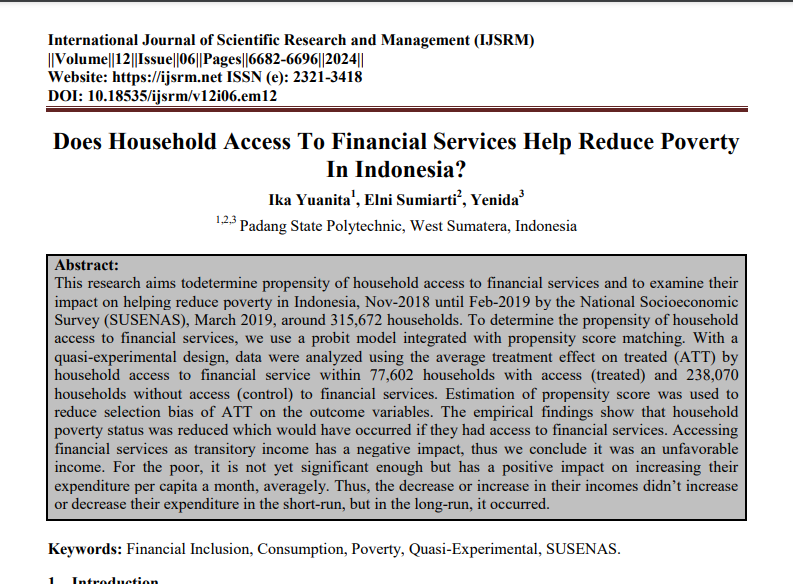

This research aims todetermine propensity of household access to financial services and to examine their impact on helping reduce poverty in Indonesia, Nov-2018 until Feb-2019 by the National Socioeconomic Survey (SUSENAS), March 2019, around 315,672 households. To determine the propensity of household access to financial services, we use a probit model integrated with propensity score matching. With a quasi-experimental design, data were analyzed using the average treatment effect on treated (ATT) by household access to financial services (treatment) within 77,602 households with access (treated) and 238,070 households without access (control) to financial services. Estimation of propensity score was used to reduce selection bias of ATT on the outcome variables. The empirical findings show that household poverty status was reduced which would have occurred if they had access to financial services. Accessing financial services as transitory income has a negative impact, thus we conclude it was an unfavorable income. For poor, it is not yet significant enough but has a positive impact on increasing their expenditure per capita a month, averagely. Thus, the decrease or increase in their incomes didn’t increase or decrease their expenditure in the short-run, but in the long-run, it occurred.

References

- Adji, A., Hidayat, T., Tuhiman, H., Kurniawati, S., & Maulana, A. (2020). Pengukuran Garis Kemiskinan di Indonesia: Tinjauan Teoretis dan Usulan Perbaikan. TNP2K.

- Akotey, J. O., & Adjasi, C. K. D. (2016). Does Microcredit Increase Household Welfare in the Asence of Microinsurance? World Development, 77, 380–394.

- Allen, F. (2012). Trends in Financial Innovation and their Welfare Impact: an Overview. European Financial Management, 18(4), 493–514.

- Allen, F., Demirguc-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. Journal of Financial Intermediation, 27, 1–30.

- Arpino, B., & Mealli, F. (2011). The Specification of the Propensity Score in Multilevel Observational Studies. Computational Statistics & Data Analysis, 55(4), 1770–1780.

- Austin, P. (2011). An Introduction to Propensity Score Methods for Reducing the Effects of Confounding in Observational Studies. Multivariate Behavioral Research, 46, 399–424.

- Badan Pusat Statistik, R. I. (2019). Survei Sosial Ekonomi Nasional, Maret 2019. Jakarta: BPS.

- Badan Pusat Statistik, R. I. (2020). Statistik Indonesia 2020. Jakarta: BPS.

- Banerjee, A., Duflo, E., Glennerster, R., & Kinnan, C. (2015). The Miracle of Microfinance? Evidence from a Randomized Evaluation. American Economic Journal: Applied Economics, 7(1), 22–53.

- Banerjee, A. V, & Duflo, E. (2007). The Economic Lives of the Poor. Journal of Economic Perspectives, 21(1), 141–167.

- Barr, M. S., Kumar, A., & Litan, R. E. (2007). Building Inclusive Financial Systems: a Framework for Financial Access. Rowman & Littlefield.

- Basu, P. (2006). Improving Access to Finance for India’s Rural Poor. World Bank Publications.

- Beck, T., Demirgüç-Kunt, A., & Honohan, P. (2009). Access to Financial Services: Measurement, Impact, and Policies. World Bank Research Observer, 24(1).

- Berry, A., & Serieux, J. (2006). Riding the Elephants: The Evolution of World Economic Growth and Income distribution at the End of the Twentieth Century (1980-2000).

- Bhalla, S. S. (2002). Imagine There’s No Country: Poverty, Inequality, and Growth in the Era of Globalization. Peterson Institute.

- Bhandari, A. K. (2009). Access to Banking Services and Poverty Reduction: a State-Wise Assessment in India. IZA Discussion Papers 4132, Institute of Labor Economics (IZA).

- Bocher, T. F., Alemu, B. A., & Kelbore, Z. G. (2017). Does Access to Credit Improve Household Welfare? Evidence from Ethiopia Using Endogenous Regime Switching Regression. African Journal of Economic and Management Studies, 8(1), 51–65.

- Charitonenko, S., Afwan, I., & Bank, A. D. (2003). Commercialization of Microfinance: Indonesia. Asian Development Bank.

- Chen, S., & Ravallion, M. (2010). The Developing World is Poorer than We Thought, but No Less Successful in the Fight Against Poverty. The Quarterly Journal of Economics, 125(4), 1577–1625.

- Coleman, B. E. (1999). The Impact of Group Lending in Northeast Thailand. Journal of Development Economics, 60(1), 105–141.

- Coleman, B. E. (2006). Microfinance in Northeast Thailand: Who Benefits and How Much? World Development, 34(9), 1612–1638.

- Cunningham, S. (2021). Causal Inference: The Mixtape. Yale University Press.

- De Silva, I. (2012). Evaluating the Impact of Microfinance on Savings and Income in Sri Lanka:Quasi-experimental Approach Using Propensity Score Matching. Margin: The Journal of Applied Economic Research, 6(1), 47–74.

- Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring Financial Inclusion: Explaining Variation in Use of Financial Services Across and within Countries. Brookings Papers on Economic Activity, 2013(1), 279–340.

- Dong, N., Stuart, E. A., Lenis, D., & Quynh Nguyen, T. (2020). Using Propensity Score Analysis of Survey Data to Estimate Population Average Treatment Effects: A Case Study Comparing Different Methods. Evaluation Review, 44(1), 84–108.

- Duesenberry, J. S. (1949). Income, Saving, and the Theory of Consumer Behavior. Harvard.

- Friedman, M. (1957). Theory of the Consumption Function. Princeton University Press.

- Garrido, M. M., Kelley, A. S., Paris, J., Roza, K., Meier, D. E., Morrison, R. S., & Aldridge, M. D. (2014). Methods for Constructing and Assessing Propensity Scores. Health Services Research, 49(5), 1701–1720.

- Helms, B. (2006). Access for All: Building Inclusive Financial Systems. World Bank Publications.

- Hill, H. (2021). What’s Happened to Poverty and Inequality in Indonesia over Half a Century? Asian Development Review, 38(1), 68–97.

- Honohan, P. (2005). Measuring Microfinance Acess: Building on Existing Cross-Country Data.

- Honohan, P. (2008). Cross-Country Variation in Household Access to Financial Services. Journal of Banking & Finance, 32(11), 2493–2500.

- Hossain, M. (1988). Credit for Alleviation of Rural Poverty: The Grameen Bank in Bangladesh (Vol. 65). Intl Food Policy Res Inst.

- Imbens, G. W., & Wooldridge, J. M. (2009). Recent developments in the econometrics of program evaluation. Journal of Economic Literature, 47(1), 5–86.

- Islam, A., & Maitra, P. (2012). Health Shocks and Consumption Smoothing in Rural Households: Does Microcredit have a Role to Play? Journal of Development Economics, 97(2), 232–243.

- Jain, M. K., & Munoz, B. T. (2017). Do Rural Microcredit Borrowers Fare Better in Reducing Poverty than Urban Borrowers. Oikocredit, Berkenweg, 7, 3818.

- Jann, B. (2017). Kernel Matching with Automatic Bandwidth Selection. STATA.

- Jiang, Y., & Liu, Y. (2022). Does Financial Inclusion Help Alleviate Household Poverty and Vulnerability in China? Plos One, 17(10), e0275577.

- Johar, M., Soewondo, P., Pujisubekti, R., Satrio, H. K., & Adji, A. (2019). In Data We Trust? An Analysis of Indonesian Socioeconomic Survey Data. Bulletin of Indonesian Economic Studies, 55(1), 61–82.

- Karlan, D., & Morduch, J. (2010). Access to Finance. In Handbook of development economics (Vol. 5, pp. 4703–4784). Elsevier.

- Karlan, D., Ratan, A. L., & Zinman, J. (2014). Savings by and for the Poor: A Research Review and Agenda. Review of Income and Wealth, 60(1), 36–78.

- Karlan, D., & Zinman, J. (2010). Expanding Credit Access: Using Randomized Supply Decisions to Estimate the Impacts. The Review of Financial Studies, 23(1), 433–464.

- Keynes, J. M. (1936). The General Theory of Employment, Interest and Money. London: McMillan.

- Khandker, S. R. (1998). Micro‐Credit Programme Evaluation: A Critical Review 1. IDS Bulletin, 29(4), 11–20.

- Khandker, S. R. (2005). Microfinance and Poverty: Evidence Using Panel Data from Bangladesh. The World Bank Economic Review, 19(2), 263–286.

- Khandker, S., & Samad, H. (2013). Are Microcredit Participants in Bangladesh Trapped in Poverty and Debt? Working Papers 24, Institute of Microfinance (InM).

- King, G., & Nielsen, R. (2019). Why Propensity Scores Should Not Be Used for Matching. Political Analysis, 27(4), 435–454.

- Kraay, A., & McKenzie, D. J. (2014). Do Poverty Traps Exist? World Bank Policy Research Working Paper, 6835.

- Kuznets, S. (1946). National Income: A Summary of Findings. NBER Research, Inc.

- Loría, E. (2020). Poverty Trap in Mexico, 1992-2016. International Journal of Development Issues, 19(3), 277–301.

- Luan, D. X., & Bauer, S. (2016). Does Credit Access Affect Household Income Homogeneously Across Different Groups of Credit Recipients? Evidence from Rural Vietnam. Journal of Rural Studies, 47, 186–203.

- Mankiw, N. G. (2010). Macroeconomics, 7th Edition. Worth Publishers.

- Mehmetoglu, M., & Jakobsen, T. G. (2017). Applied Statistics Using Stata: A Guide for the Social Sciences. SAGE Publications.

- Moav and, O., & Neeman, Z. (2012). Saving Rates and Poverty: the Role of Conspicuous Consumption and Human Capital. The Economic Journal, 122(563), 933–956.

- Morduch, J. (1994). Poverty and Vulnerability. The American Economic Review, 84(2), 221–225.

- Morduch, J., & Haley, B. (2002). Analysis of the Effects of Microfinance on Poverty Reduction. RESULTS Canada for the Canadian International Development Agency (CIDA).

- National Strategy on Indonesian Financial Inclusion (SNKI). (2019).

- National Strategy on Indonesian Financial Literacy (SNLKI). (2019).

- National Strategy on Indonesian Financial Literacy (SNLKI) 2021 – 2025. (2021).

- Peachey, S., & Roe, A. (2004). Access to Finance. A Study for the World Savings Banks Institute.

- Pitt, M. M., & Khandker, S. R. (2002). Credit Programmes for the Poor and Seasonality in Rural Bangladesh. Journal of Development Studies, 39(2), 1–24.

- Quinones, B., & Remenyi, J. (2014). Microfinance and Poverty Alleviation: Case Studies from Asia and the Pacific. Routledge.

- Rao, V. (2001). Poverty and Public Celebrations in Rural India. The Annals of the American Academy of Political and Social Science, 573(1), 85–104.

- Reddy, S. G., & Minoiu, C. (2007). Has World Poverty Really Fallen? Review of Income and Wealth, 53(3), 484–502.

- Robinson, M. S. (2001). The Microfinance Revolution. The World Bank.

- Romer, D. (2012). Advanced Macroeconomics, 4e. New York: McGraw-Hill.

- Roodman, D., Nielsen, M. Ø., MacKinnon, J. G., & Webb, M. D. (2019). Fast and wild: Bootstrap inference in Stata using boottest. The Stata Journal, 19(1), 4–60.

- Sala-i-Martin, X. (2006). The World Distribution of Income: Falling Poverty and Convergence, Period. The Quarterly Journal of Economics, 121(2), 351–397.

- Sarma, M., & Pais, J. (2011). Financial Inclusion and Development. Journal of International Development, 23(5), 613–628.

- Simatele, M. (2021). Financial Inclusion in Africa: Lessons and Implications (pp. 235–241).

- SOFIA. (2017). Survey on Financial Inclusion and Access. Oxford Policy Management.

- Suleiman, A., Dewaranu, T., & Anjani, N. H. (2022). Creating Informed Consumers: Tracking Financial Literacy Programs in Indonesia. In Center for Indonesian Policy Studies. Center for Indonesian Policy Studies.

- Syahruddin. (1981). Fungsi Konsumsi: Kenyataannya di Sumatera Barat. Economics and Finance in Indonesia, 29, 207–232.

- Tilakaratna, G., Wickramasinghe, U., & Thusitha, K. (2005). Microfinance in Sri Lanka : A Household Level Analysis of Outreach and Impact on Poverty Sri Lanka.

- TNP2K. (2019). Menanggulangi Kemiskinan dan Mengurangi Kesenjangan melalui Peningkatan Efektivitas Kebijakan dan Program: Laporan Pelaksanaan Tugas Sekretariat TNP2K 2015–2019: National Team for the Acceleration of Poverty Reduction. The National Team for the Acceleration of Poverty Reduction (TNP2K) Jakarta.

- TNP2K, T. (2021). Pemetaan Program Pemberdayaan Usaha Mikro, Kecil, dan Menengah (UMKM). Jakarta: Tim Nasional Percepatan Penanggulangan Kemiskinan.

- Uddin, G. S., Shahbaz, M., Arouri, M., & Teulon, F. (2014). Financial Development and Poverty Reduction Nexus: a Cointegration and Causality Analysis in Bangladesh. Economic Modelling, 36, 405–412.

- World Bank. (2010). Improving Access to Financial Services in Indonesia. World Bank Report, 2(52032), 1–196.