Factors affecting customer satisfaction with life insurance service quality: A case study in Hanoi

Submission to VIJ 2024-05-21

Keywords

- influencing factors,

- Satisfaction,

- service quality,

- insurance services

Copyright (c) 2024 Thanh Tung Hoang, Nguyen Thao Ly, Le Hoang Anh, Doan Nguyen Nhat Anh

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

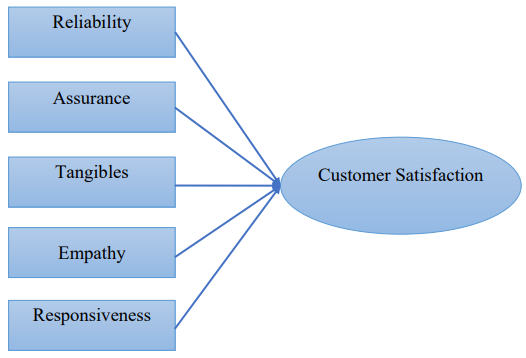

This study aims to identify and evaluate factors that affect customer satisfaction in Hanoi with insurance services at a life insurance company. With 259 questionnaire survey samples, the research team used SPSS statistical software to test the research hypotheses. Research results show that 3/5 factors of service quality, including Assurance, Tangibles, and Responsiveness, positively impact customer satisfaction, while 2/5 factors, Reliability and Empathy, are not statistically significant enough to conclude the relationship affecting customer satisfaction. From the research results, the authors have proposed solutions to improve the quality of insurance services to increase customer satisfaction and promote the sustainable development of insurance businesses.

References

- Quynh Le (2023, Doanh thu bảo hiểm toàn thị trường đạt 112.741 tỷ đồng trong nửa đầu năm 2023, giảm 5% so với cùng kỳ. [Insurance revenue for the entire market reached VND 112,741 billion in the first half of 2023, down 5% over the same period]. Retrieved from https://thitruongtaichinhtiente.vn

- Nguyen Dinh Tho, (2013). Textbook of scientific research methods in business (2nd ed.), Finance Publishing House.

- Tung Thu (2022). Giáo trình phương pháp nghiên cứu khoa học trong kinh doanh [Life insurance revenue growth may reach 15% in the next 5 years]. Retrieved from https://mof.gov.vn/

- Overview of Vietnam insurance market in the first 6 months of 2023 (2023) and Overview of Vietnam Insurance market in the first 9 months of 2022 (2022). Retrieved from https://www.iav.vn/

- Hoang Trong and Chu Nguyen Mong Ngoc (2005). Phân tích dữ liệu nghiên cứu SPSS [Analyzing SPSS research data], Statistics Publishing House, 263.

- Cam Tu (2017). Người Việt gia tăng nhận thức về bảo hiểm nhân thọ [Vietnamese people increase awareness about life insurance] , Retrieved from https://mof.gov.vn/

- Comrey, AL, & Lee, HB (1992). A First Course In Factor Analysis (2nd ed .), Hillsdale, NJ: Lawrence Erlbaum.

- Gerbing, D. W. & Anderson, J. C. (1988). An Update Paradigm For Skill Development Incorporating Unidimensionally . Journal of Marketing Research 25(2): 186-192.

- Gorsuch, R. (1983). Factor analysis (2nd ed .). Hillsdale, NJ: Lawrence Erlbaum Associates.

- Hair, JF, Black, WC, Babin, PJ, Anderson, RE, & Tatham, RL (2014). Multivariate Data Analysis (6th ed .). Upper Saddle River, NJ: Prentice Hall.

- Hansemark and Albinsson (2004) . Customer satisfaction and retention: The experiences of individual employees . Journal of Services Marketing, 18(7), 588-605 , 590 .

- Philip Kotler & Kevin Lan Keller (2006). Marketing Management (12th ed .). Upper Saddle River, NJ: Prentice Hall

- Nunnally, J.C., and Bernstein, I.H. (1994). Psychometric theory (3rd ed.). New York: McGraw-Hill. 245

- Richard L. Oliver (2010). Satisfaction: A behavioral perpeetive on the consumer. (2nd ed .). New York: Armork.

- Parasuraman A., Zeithaml VA & Berry LL (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49,41-50/

- Parasuraman et al (1988, 1991, 1993). SERVQUAL: A Multiple – Item. Scale for Measuring Consumer Perceptions of Service Quantity , Journal of Retailing, 64.12-40.

- Tabanick BG, Fidell LS, (1996) Multivariate Date Analysis (3rd ed .) New York: Harper Collins.