Navigating Loan Recovery Process from SMEs: Identifying Critical Challenges for Microfinance Institutions in Tanzania

Submission to VIJ 2024-04-12

Keywords

- Loans Recovery, Loan Recovery Challenges, Small Medium Enterprises, Microfinance Institutions

Copyright (c) 2024 Richard Sikira, Madaba R, Filbert R

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

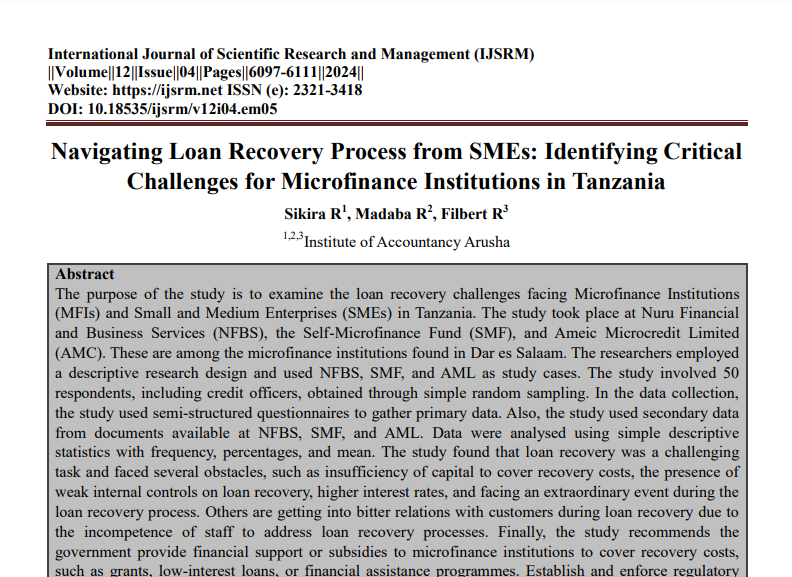

The purpose of the study is to examine the loan recovery challenges facing Microfinance Institutions (MFIs) and Small and Medium Enterprises (SMEs) in Tanzania. The study took place at Nuru Financial and Business Services (NFBS), the Self-Microfinance Fund (SMF), and Ameic Microcredit Limited (AMC). These are among the microfinance institutions found in Dar es Salaam. The researchers employed a descriptive research design and used NFBS, SMF, and AML as study cases. The study involved 50 respondents, including credit officers, obtained through simple random sampling. In the data collection, the study used semi-structured questionnaires to gather primary data. Also, the study used secondary data from documents available at NFBS, SMF, and AML. Data were analysed using simple descriptive statistics with frequency, percentages, and mean. The study found that loan recovery was a challenging task and faced several obstacles, such as insufficiency of capital to cover recovery costs, the presence of weak internal controls on loan recovery, higher interest rates, and facing an extraordinary event during the loan recovery process. Others are getting into bitter relations with customers during loan recovery due to the incompetence of staff to address loan recovery processes. Finally, the study recommends the government provide financial support or subsidies to microfinance institutions to cover recovery costs, such as grants, low-interest loans, or financial assistance programmes. Establish and enforce regulatory standards for internal controls within microfinance institutions. Implementing policies to regulate interest rates charged by microfinance institutions to ensure fairness and transparency. Establish a legal framework to handle extraordinary events during the loan recovery process. Microfinance institutions should explore partnerships with international development organisations, impact investors, or donor agencies to secure additional funding for loan recovery efforts. Loan officers should be trained in cost-effective recovery strategies, and SMEs should engage in responsible borrowing practices to minimise the risk of default.

References

- Ahmad, H. G. (2023). An assessment of factors determining loan repayment performance of SMEs in Gwarzo local government – a review. Journal of Global Economics and Business, 4(12), 167-177. https://doi.org/10.31039/jgeb.v4i12.127

- Babajide, A. A., Taiwo, J., & Adetiloye, K. A. (2017). A comparative analysis of the practice and performance of microfinance institutions in Nigeria. International Journal of Social Economics, 44(11), 1522-1538. https://doi.org/10.1108/ijse-01-2016-0007

- Casquilho-Martins, I. & Mauritti, R. (2022). Responses to Covid-19 social and economic impacts: a comparative analysis in southern European countries. Social Sciences, 11(2), 36. https://doi.org/10.3390/socsci11020036

- Charrier, P., Occelli, P., Buchet-Poyau, K., Douplat, M., Delaroche-Gaudin, M., Fayard-Gonon, F., … & Touzet, S. (2021). Strategies used by emergency care professionals to handle interpersonal difficulties with patients: a qualitative study. BMJ Open, 11(2), e042362. https://doi.org/10.1136/bmjopen-2020-042362

- Ebenezer, O., Gideon, O., & Uwineza, D. (2020). Microfinance and women’s empowerment in Ghana: challenges and prospects. International Journal of Academic Research in Business and Social Sciences, 10(10). https://doi.org/10.6007/ijarbss/v10-i10/7945

- Gatimu, E. M., & Kalui, F. M. (2014). Assessing Institutional Factors Contributing to Loan Defaulting in Microfinance Institutions in Kenya. IOSR Journal of Humanities and Social Science (IOSR-JHSS, 19(5), 105–123. Retrieved from www.iosrjournals.org

- Gbadago, S. K. (2016). Turning around a high loan defaulting microfinance institution: the case of express savings and loans limited. Texila International Journal of Management, 2(2), 80-110. https://doi.org/10.21522/tijmg.2015.02.02.art008

- Gyimah, A. G., Agyeman, A. S., & Adu-Asare, S. (2020). Assessing the impact of operational flaws on the performance of microfinance institutions in Ghana. International Finance and Banking, 7(1), 37. https://doi.org/10.5296/ifb.v7i1.15753

- Hasan, M. (2021). Private lenders and borrowers’ internal control weaknesses. Journal of Corporate Accounting & Finance, 32(4), 71-83. https://doi.org/10.1002/jcaf.22517

- Islam, R., Karim, M., & Ahmad, R. (2018). Forced loan-recovery technique of the microfinance institutes in Bangladesh and its impact on the borrowers: an empirical study on Grameen bank, Brac and Asa. Journal on Innovation and Sustainability Risus, 9(3), 75. https://doi.org/10.24212/2179-3565.2018v9i3p75-93

- Kaua, C. G., Thenya, T., & Mutheu, J. M. (2021). Analyzing effects of climate variability in the nexus of informal microfinance institutions: a case study of Tharaka south subcounty, Kenya. Challenges in Sustainability, 9(1). https://doi.org/10.12924/cis2021.09010001

- Kasoga, P. S. and Tegambwage, A. G. (2021). An assessment of over-indebtedness among microfinance institutions’ borrowers: the Tanzanian perspective. Cogent Business & Management, 8(1). https://doi.org/10.1080/23311975.2021.1930499

- Kar, S. (2013). Recovering debts: Microfinance loan officers and the work of “proxy-creditors” in India. American Ethnologist, 40(3), 480–493. https://doi.org/10.1111/amet.12034

- Kitomo, D., Likwachala, R., & Swai, C. (2020). Financial management practices among micro-enterprises and their implications for loan repayment: a case of solidarity group lending of DCB commercial bank in Dar es Salaam. International Journal of Economics and Finance, 12(12), 122. https://doi.org/10.5539/ijef.v12n12p122

- Kuye, O. and Edem, T. O. (2019). Determinants of loan repayment among small-scale cassava farmers in Akpabuyo local government area of Cross River State, Nigeria. Asian Journal of Agricultural Extension, Economics & Sociology, 1-11. https://doi.org/10.9734/ajaees/2019/v35i330221

- Lwesya, F. and Mwakalobo, A. (2023). Frontiers in microfinance research for small and medium enterprises (SMEs) and microfinance institutions (MFIs): a bibliometric analysis. Future Business Journal, 9(1). https://doi.org/10.1186/s43093-023-00195-3

- Makorere, R. F. (2014). Factors affecting loan repayment behaviour in Tanzania: Empirical evidence from Dar es Salaam and Morogoro regions. International Journal of Development and Sustainability, 3(3), 481-492.

- Mpinge, P. P. (2014). Loan Recovery and Credit Policy in Microfinance Institutions: A Case of FINCA Magomeni Branch, Dar-Es-Salaam, Tanzania. July.

- Mulatu, E. (2020). Determinants of Smallholder Farmers’ Saving: The Case of Omo Microfinance Institution in Gimbo District of Kaffa Zone, Southern Ethiopia. Journal of Accounting and Finance, 5, 93.

- Nininahazwe, P. (2023). Analyzing the effects of credit management practices on loan repayment performance of microfinance institutions in Makamba, Burundi. International Journal of Current Aspects in Finance Banking and Accounting, 5(2), 49-70. https://doi.org/10.35942/416j5039

- Ninson, A., Sidza, A., & Ampah, D. (2021). The nexus among non-performing loans, lending rates and financial performance of banks in Ghana. International Journal of Finance and Banking Research, 7(5), 123. https://doi.org/10.11648/j.ijfbr.20210705.13

- Nyamboga, T. O., Nyamweya, B. O., Abdi, M. A., Njeru, F. & Gongera, E. G. (2014). An Assessment of Financial Literacy on Loan Repayment by Small and Medium Entrepreneurs in Ngara, Nairobi County. Research Journal of Finance and Accounting, 5 (12), 181-192.

- Offiong, A. I., & Egbuka, N. (2017). The Efficiency of Loan Recovery Rate in Deposit Money Banks in Nigeria. Journal of Finance and Bank Management, 5(2). https://doi.org/10.15640/jfbm.v5n2a4

- Okwara, M. O., Umebali, E. E., Agu-Aguiyi, F. N., & Anyanwu, U. G. (2019). Efficiency of microfinance banks’ lending to agriculture in Imo state, Nigeria. Asian Journal of Agricultural Extension, Economics & Sociology, 1-7. https://doi.org/10.9734/ajaees/2019/v36i230242

- Ozili, P. K. (2019). Non-performing loans and financial development: new evidence. The Journal of Risk Finance, 20(1), 59-81. https://doi.org/10.1108/jrf-07-2017-0112

- Saleh, H. (2013). Factors Hindering Loan Recovery: A Case of CRDB Bank Plc- Lake Zone. http://scholar.mzumbe.ac.tz/handle/11192/564

- Semusu, A. & Turyasingura, B. (2023). Nonperforming loans and performance of financial institutions in East Africa: Evidence from Kabale district, Uganda. International Journal of Finance and Accounting, 2(1), 9-20. https://doi.org/10.37284/ijfa.2.1.1193

- Sikira, R. (2021). Loan recovery procedures in Tanzania: A case of selected microfinance institutions in Dar-Es-Salaam, Tanzania. International Journal of Scientific Research and Management, 9(05), 2172-2184. [DOI](https://doi.org/10.18535/ijsrm/v9i05.em01)

- Soedarmono, W. and Sitorus, D. (2016). Abnormal loan growth, credit information sharing and systemic risk in Asian banks. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2847744

- Sungwacha, S. Wanyama, B. S. & Kirathi, M. (2014). Factors influencing loan repayment performance among group borrowers in Bungoma West District, Bungoma County. International Journal of Disaster Management and Risk Reduction, 6 (1), 63-64.

- Wafula, J., Maingi, M., & Bulla, D. (2023). Effect of Credit Monitoring Practices on Loan Non-performance among Microfinance Institutions in Nairobi County, Kenya. African Journal of Empirical Research.

- Worku, Y. and Muchie, M. (2019). The survival of business enterprises and access to finance: the case of 4 African countries. Problems and Perspectives in Management, 17(1), 326-338. https://doi.org/10.21511/ppm.17(1).2019.28

- Xue, W., & Taylor, J. E. (2018). Recovery from the Asian financial crisis: the importance of non‐monetary financial factors. Asian‐Pacific Economic Literature, 32(2), 27-41.

- Zahid, I. and Rao, Z. (2022). Social capital and loan credit terms: does it matter in microfinance contract? Journal of Asian Business and Economic Studies, 30(3), 187-209. https://doi.org/10.1108/jabes-10-2021-0185