Submission to VIJ 2023-12-16

Keywords

- Murabahah Financing, POJK, BPRS

Copyright (c) 2023 Muhammad Zahri, Busra, Muhammad Nasir

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

This research aims to determine the extent of risk management is implemented in murabahah financing at BPRS in Aceh Province before and after the implementation of POJK No.23/POJK.03/2018. Before the POJK came into effect, BPRS did not have specific regulations regarding the implementation of risk management and were guided by the internal regulations of each BPRS, whereas after POJK No.23/POJK.03/2018 came into effect, BPRS were obliged to follow the regulations in this regulation, in this case the Financial Services Authority (OJK) regarding the implementation of risk management and must update the internal regulations of each BPRS to adapt to the POJK. This research uses primary data, namely information from interviews with parties who carry out risk management and documentation from the BPRS in Aceh Province. Methodology used is a qualitative descriptive research, and then collecting the data obtained then interpreting and analyzing it so that it can provide information that is used to solve the problems faced. The research results show that the application of risk management to murabahah financing at BPRS in Aceh Province before POJK No.23/POJK.03/2018 came into effect obtained the highest score is 94% and the lowest 61%. And Then after POJK No.23/POJK.03/2018 came into effect, there were significant changes with the highest average value being 100% and the lowest 80% assessed based on indicators in accordance with OJK provisions. The implications of implementing risk management for murabahah financing, if it is not implemented correctly, is the potential risk of financing problems and the level of BPRS soundness decreasing.

References

- Danim, Sudarwan (2002). Menjadi Peneliti Kualitatif. Pustaka Setia. Bandung.

- Darwin dan Siregar, Saparuddin. (2020). Proses Pelaksanaan Manajemen Risiko Pada Pembiayaan Murabahah di BPRS Haji Miskin Pandai Sikek Kabupaten Tanah Datar, Provinsi Sumatera Barat. Ekonomi, Keuangan, Investasi dan Syariah (EKUITAS) Vol 1, No 2.

- Fakhrurozi, M, Warsiyah., & Kesumah, F. S. (2021). Analisis Penerapan Manajemen Risiko Pembiayaan Baitut Tamwil Muhammadiyah Bina Masyarakat Utama Bandar Lampung. Jurnal Ilmiah Ekonomi Islam, 7(03), 2021, 1548.

- Fawziyah dan Isfandayani. (2020). Analisis Manajemen Risiko Pembiayaan Murabahah Di Pt Bprs Artha Madani Kantor Pusat Bekasi. Jurnal Paradigma. Vol. 17. No 2. 2020 ISSN No. 0853-9081.

- Kothari, C.R. (2004). Research Methodology methods and Techniques: Second Revised Edition. New Age International publishers. New Delhi.

- Muhammad. (2014. Manajemen Dana Bank Syariah. Rajawali Pers. Jakarta.

- Moleong, Lexy. J. (2000). Metodologi Penelitian Kualitatif. PT Remaja Rosdakarya. Bandung.

- Nengsih, Ifelda (2022). .Analisis Penerapan Manajemen Risiko Pembiayaan Murabahah Di Bank Nagari Syariah Cabang Batusangkar. JPRO Vol. 3 No. 1 Tahun 2022 E-ISSN : 2775-5967.

- Nasution, Syahdinar. (2023).Analisis Risiko Pembiayaan Murabahah pada Perbankan Syariah. Jurnal Ilmu Komputer, Ekonomi dan Manajemen (JIKEM)Vol. 3 No. 1, age 107-119.

- Nasution, Atiqi Chollisni dan Hafidzy, Abdullah. (2021) Analisis Manajemen Risiko Pada Pembiayaan Murabahah Di BPRS Berkah Ramadhan. Journal Of Islamic Banking And Finance. Vol: 01 No. 01, Jan-Juni.

- Otoritas Jasa keuangan (OJK). (2023). Laporan Profil Industri Perbankan.

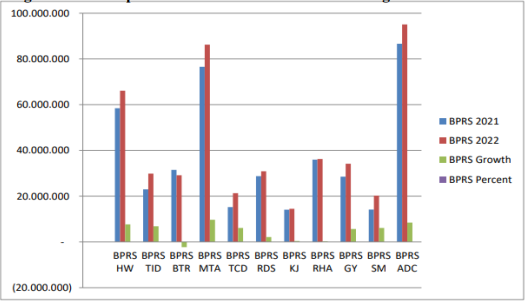

- Otoritas Jasa keuangan (OJK). (2023). Laporan Keuangan Publikasi BPRS Tahun 2021-2022.

- Peraturan Otoritas Jasa Keuangan Nomor 23/POJK.03/ 2018.Tentang Manajemen Risiko BPRS.

- Qanun Aceh (2018). Tentang Lembaga Keuangan Syariah. No.11 tahun 2018.

- Rozalinda. (2015). Fikih Ekonomi Syariah. Rajawali Pers. Padang.

- Siregar, Syofian. (2014). Statistik Parametrik Untuk Penelitian Kuantitatif. Bumi Aksara. Jakarta.

- Sulhan dan Siswanto. 2008. Manajemen Bank Konvensional dan Syariah. Malang. UIN Malang.

- Sumar’in. 2012. Konsep Kelembagaan Bank Syariah. Graha Ilmu. Yogyakarta.

- Suhaimi, A. (2021). Studi Manajeman risiko Pada Bank Syariah Indonesia (BSI). Jurnal Manajemen Risiko, 2(1), 73-78.

- Sugiyono. (2019). Metode Penelitian Bisnis. Alfabeta. Bandung.

- Undang-undang No. 21 Tahun 2008 tentang Perbankan Syariah.

- Wahyuni, Neneng dan Nuroktafiani, Farida. (2021). Penerapan Manajemen Risiko Pembiayaan Murabahah Pada Bank BNI Syariah KCP Kuningan. Jurnal Fakultas Ilmu Keislaman Vol. 2 No. 2.

- Wangsawidjaja A. 2012. Pembiayaan Bank Syari’ah. PT Gramedia Pustaka Utama. Jakarta